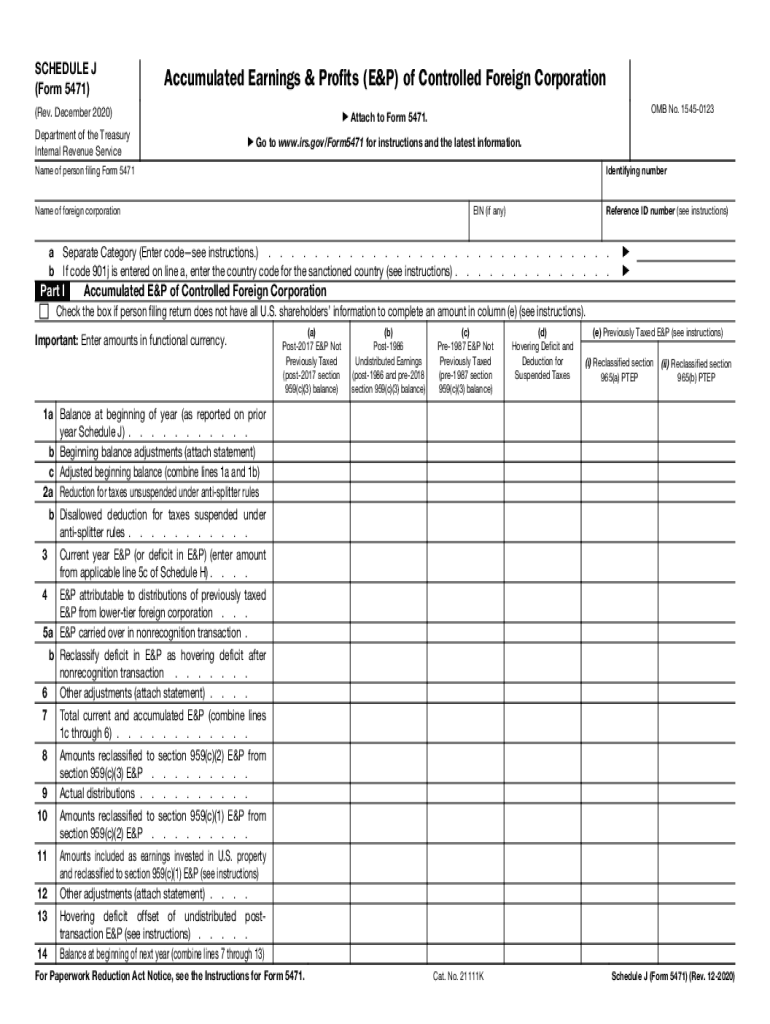

Who needs Form 5471 Schedule J?

Form 5471 is a complex tax document for U.S. citizens and residents working in a foreign corporation. The form consists of many schedules, each designed for a particular purpose. There are five categories of filers who may need to complete a particular schedule. Schedule J is the Accumulated Earnings and Profits of Controlled Foreign Corporation form. It must be filed by officers or directors of a foreign corporation or by employees who own 10% or more of the corporation.

What is Form 5471 Schedule J for?

The purpose of Schedule J is to report the accumulated earnings that a person gets at a foreign corporation. It means that everyone who occupied a senior position in a foreign company for no less than 30 days or owned stock there during the tax year must fill out Schedule J of Form 5471.

Is Form 5471 Schedule J accompanied by other forms?

Schedule J belongs to Form 5471. Therefore, it must be attached to it before submission.

When is Form 5471 Schedule J due?

Generally, the due date for the schedule coincides with the due date of the income tax return. For individuals this would be 15th of April except for the cases when this date is a federal holiday or a weekend. If so, the deadline is moved to the next business day.

How do I fill out Form 5471 Schedule J?

Schedule J is a brief document. However, it contains lots of calculations. Start filling out the schedule with personal information. Enter your name and the name of the foreign corporation. Then proceed with the calculations. There are seven fields designed for amounts of different kinds. All the amounts must be provided in functional currency.

Where do I send Form 5471 Schedule J?

When you are ready with Schedule J attach it to Form 5471 and mail it to the IRS.