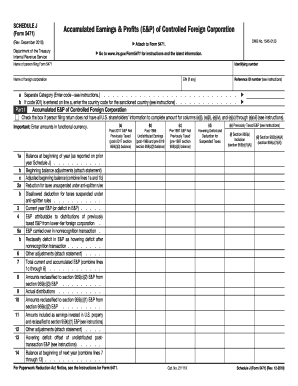

IRS 5471 - Schedule J 2020-2026 free printable template

Instructions and Help about IRS 5471 - Schedule J

How to edit IRS 5471 - Schedule J

How to fill out IRS 5471 - Schedule J

Latest updates to IRS 5471 - Schedule J

All You Need to Know About IRS 5471 - Schedule J

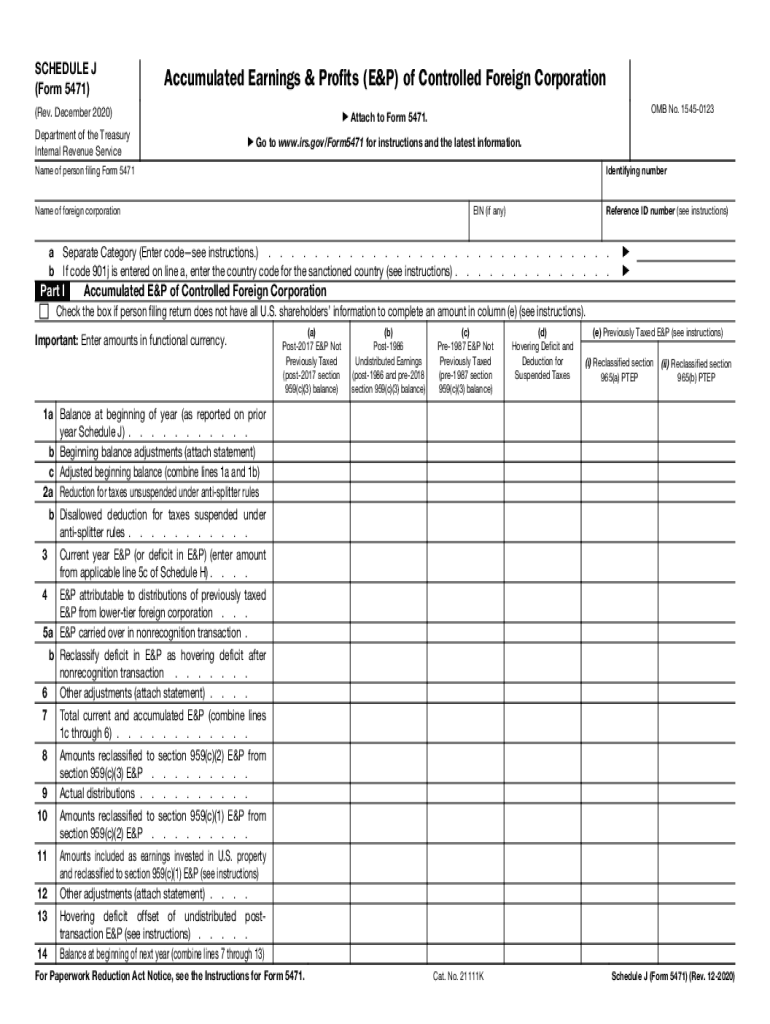

What is IRS 5471 - Schedule J?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 5471 - Schedule J

What to do if you discover an error after filing IRS 5471 - Schedule J?

If you find an error after submitting the IRS 5471 - Schedule J, you will need to file an amended return. This involves preparing a corrected version of the form and indicating it as an amendment. Be sure to keep a copy of the original and the amended form for your records, and check the IRS guidelines for submitting amendments to ensure compliance.

How can you verify that your IRS 5471 - Schedule J has been processed?

To verify the processing status of your IRS 5471 - Schedule J, you can use the IRS 'Where's My Refund?' tool, which provides information on the status of your submission. Additionally, you should retain any confirmation emails or numbers received after submission, as they may contain specific details regarding your filing.

What common errors should you watch out for when filing IRS 5471 - Schedule J?

Common errors when filing IRS 5471 - Schedule J include mismatched information between the form and supporting documentation, failure to sign, or missing required attachments. To avoid these pitfalls, double-check all entries for accuracy and compliance with IRS specifications before submission.

What are your options if your submission of IRS 5471 - Schedule J is rejected?

If your submission of IRS 5471 - Schedule J is rejected, the IRS will usually provide a reason for the rejection. You can correct the identified issues and resubmit the form electronically or by mail. It's also essential to keep track of any deadlines to ensure compliance with filing requirements.

Can you file IRS 5471 - Schedule J on behalf of someone else?

Yes, you can file IRS 5471 - Schedule J on behalf of someone else if you have the appropriate authorization, such as a Power of Attorney (POA). Ensure that you adhere to all privacy regulations and file the form in accordance with the individual's tax obligations.